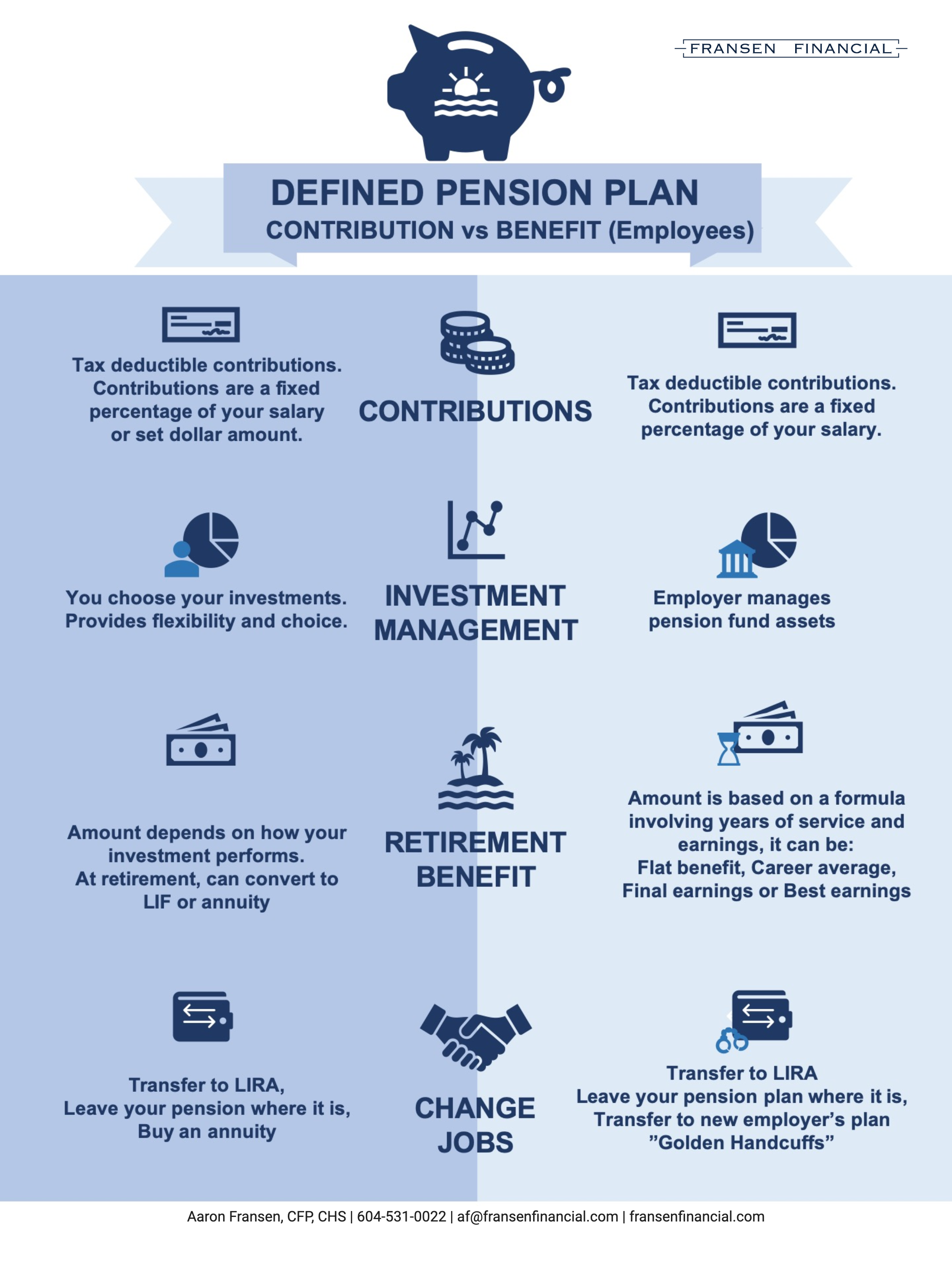

As the names imply a defined-benefit planalso commonly known as a traditional pension plan provides a specified payment amount in retirement. A defined contribution pension plan DCPP or DC plan is one type of a Registered Pension Plan.

Prosperiguide Defined Contribution Dc Pension Plans

Prosperiguide Defined Contribution Dc Pension Plans

A simple example is a Dollars Times Service plan design that provides a certain amount per month based on the time an employee works for a company.

Defined contribution pension plan. Defined benefit plans are largely funded by employers with retirement payouts. The money in your defined contribution pension is invested in one or more products on your behalf. The pension options you have will depend on a few different things but the biggest issues are the amount of money you have in the pension and your age.

Contributions earn employees and employers valuable tax. A defined contribution plan is a type of employer-sponsored retirement plan funded by contributions from employers or employeesor both. An example of how this might work follows.

Under a defined contribution plan employees and the employer are allowed to contribute money towards the pension plan. In defined contribution plans future benefits fluctuate on the basis of investment earnings. Defined Benefit Plan Contributions Are Tax-deductible As mentioned when prefunding the Defined Benefit Plan employer contributions up to the maximum annual limit are tax-deductible.

The plan differs slightly based on the specific policies that the company you work for employs but it has the same essential principle. Moreover employees are not taxed on the employer contributions that are made on their behalf. A defined contribution plan is a type of retirement plan in which the employer employee or both make contributions on a regular basis.

In the United States a 401k plan is an employer-sponsored defined-contribution pension account defined in subsection 401k of the Internal Revenue Code. Depends on your age. These contributions are often a fixed percentage of an employees annual earnings and are deposited monthly in an individual account in the members name.

When you retire from a Defined Contribution Pension Plan your retirement options are very different than the options from a Defined Benefit Pension Plan. The Defined Contribution Pension Plan DCPP in Canada refers to a registered pension plan that you can retire within Canada. The investment risk is borne by the beneficiary not the plan.

The defined-contribution plan differs from a defined-benefit plan also called a pension plan which guarantees participants receive a certain benefit at a specific future date. An employer might contribute towards an employees pension pot based on the latters age salary and years of service with the business. A DCPP has no pre-determined payout at retirement it is based on the assets in the plan at the time your retire.

Pension Plans are the foundation of retirement planning. Variously referred to as traditional vs. In a defined contribution pension plan the contributions are known defined and guaranteed and the benefits will vary depending on the investment performance of the plan.

There are two main types corresponding to the same distinction in an Individual Retirement Account IRA. The most common type of defined contribution plan is a savings and thrift plan. A defined-contribution pension plan is a form of retirement plan where the employee or the employer and in some cases both of them make significant amount of contributions and that too on frequent basis with a motive to enable employees to save a decent amount of money for his retirement period and allow him to leave with utmost level of dignity in his or her retirement phase.

Employee funding comes directly off their paycheck and may be matched by the employer. Usually you and your employer pay a defined amount into your pension plan each year. In a defined contribution plan the employer and employee contribute a set or defined amount and the amount of pension income that the member receives upon retirement is determined by among other things the amount of contributions accumulated and the investment income earned.

The way a Defined Contribution Pension Plan in Canada works is that you make contributions to the plan while you work for your company. In a defined contribution pension plan you know how much you will pay into the plan but not how much you will get when you retire. A defined-contribution plan allows employees and.

When you retire quit or terminate your employer will notify the pension plan and let them. Defined contribution pension schemes With a defined contribution pension you build up a pot of money that you can then use to provide an income in retirement. A defined benefit plan more commonly known as a pension plan offers guaranteed retirement benefits for employees.

The benefit in a defined benefit pension plan is determined by a formula that can incorporate the employees pay years of employment age at retirement and other factors. Employer Contributions all contributions made to the provision in respect of the individual during the year or in the first 2 months of the subsequent year if in respect of the previous year ie if a contribution is made in January or February of 2001 but in respect of 2000 then that contribution is included in the 2000 pension credit calculations. Defined Contribution Pension Plan Pension plans generally fall into two types a defined contribution pension plan or a defined benefit pension plan.

Unlike defined benefit schemes which promise a specific income the income you might get from a defined contribution scheme depends on factors including the amount you pay in the funds investment performance and the choices you make at retirement. Under this type of. Individual accounts are set up for participants and benefits are based on the amounts credited to these accounts plus any investment earnings on the money in the account.

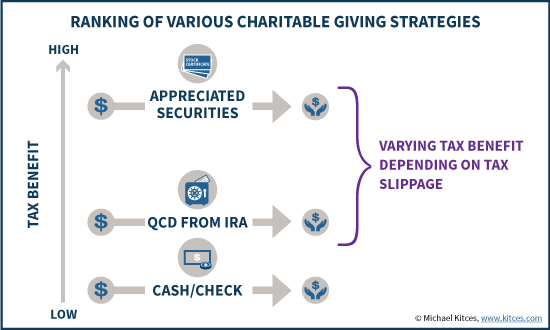

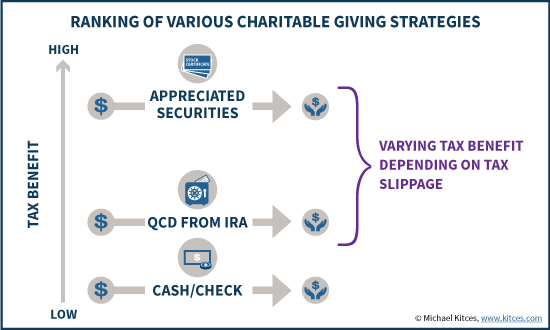

The benefits of gifting appreciated stock 1. Normally charitable deductions are limited to 50.

Using Ira Charitable Distributions Vs Donating Stocks

Using Ira Charitable Distributions Vs Donating Stocks

Contributing Appreciated Stock with Low Cost Basis One of the most common methods of annual charitable giving is through the donation of publicly traded stock to charity.

Charitable contribution of appreciated stock. For 2020 the CARES Act allows charitable deduction of up to 100 of their AGI. Giving appreciated stock youve held for more than a year is better than giving cash. Qualified appreciated stock is any stock in a corporation that is capital gain property and for which market quotations are readily available on an established securities market on the day of the contribution.

Although it is possible to gift those appreciated shares directly to a charity placing them within a donor advised fund DAF may be more beneficial. In Jon Dickinson and Helen Dickinson v. Log in to your Giving Account to get started.

First make sure that you are donating stock that you have owned for over a year. The reason is that anyone who donates stock that has appreciated in value and held it at least 12 months is able to deduct the full value of the investment without being forced to recognize the capital gain in the process. The Tax Cuts Jobs Act increased the income limit for charitable contributions of cash to public charities from 50 to 60 but not for charitable contributions of stock.

Most charities can accept appreciated stock but the process can be easier if you have a donor-advised fund. Substantiation of noncash charitable contributions of more than 5000. Gifting long-term appreciated stock as opposed to cash benefits both the charitable organization and the donor.

Now youve maximized your charitable gift and 100 of the stock value can support the charity of your choice. Gifting appreciated stock to charity If you are considering a charitable contribution this year it is in your best interest to seek out the most effective manner in which your money can work for you. For contributions of cash paid to charitable organizations in calendar year 2020 and 2020 only a corporation can claim a charitable income tax deduction up to 25 of the corporations taxable income.

Use our Appreciated Securities Tool when making a contribution to help find the most highly appreciated assets to donate. Gifting appreciated stock is one of the most effective means of tax savings available. If such stock were sold by the donor it would incur capital gain.

1 By contributing the stock to a public charity with a donor-advised fund you have the flexibility to determine how your gift can make an impact and your contribution grows tax-free in the meantime. Donation With Stock Can Be Bigger Than With Cash. If so heres a quick article on valuing your charitable stock donation.

Deductions for appreciated stock is limited up to 30 of adjusted gross income AGI in the year of the donation with a 5-year carry-forward for unused deductions. The motivation for donating appreciated stock is that it allows donors to deduct the stocks full market value and not owe capital gains tax. Stock in which the donor has little to no cost basis is particularly attractive for this purpose.

Taxpayers who are considering current year charitable contributions and are also facing long-term capital gains taxes on appreciated stock that they have held for more than a year can realize a much more favorable income tax result and charitable impact by making a timely donation of the appreciated stock directly to charity. Contact the charity to which you would like to donate. This provision does not apply to contributions to a supporting organization a donor advised fund or non-operating private foundations.

Here are five things to know about giving stock to charity to get the maximum tax break. Charitable Giving paper message on assorted cash. Shares gifted to donor.

Consider your long-term publicly traded stock for a charitable donation or ask your advisor about the best asset to contribute. With a charitable gift of appreciated securities held long-term the donation you make and the deduction you get are greater than they would be. But stock in a corporation doesnt count as qualified.

2020-128 Dickinson the Tax Court rejected the IRS position that stock transactions should have been treat. How Long Have You Owned The Stock. The Tax Court recently sustained a taxpayers deduction for contribution of appreciated stock to a charitable donor advised fund immediately before liquidation of the stock.

There were no changes in the CARES Act for deductible gift limits of 60 cash donations to donor-advised funds 30 for appreciated stock and 30 for cash gifts to private foundations 20 for appreciated stock gifts. One of the best ways to give to charity is through highly appreciated stock. The 100 of AGI contribution limit applies only to gifts of cash directly to charities not including family-funded private foundations.

30 or 20 of an investors adjusted gross income. Have a Fidelity Investments brokerage account. Here is how it works.